Food Inflation

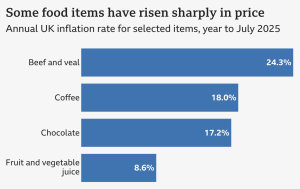

Inflation has risen to 3.8%, the highest level since January 2024. Looking at the food and non-alcoholic drink sector, prices are up 4.8%, with the highest inflation items being beef, chocolate and coffee. These increases are being driven by a combination of tightening supply, high global demand and rising labour costs.

Supply constraints can largely be factored to climate change. Heavy droughts and unpredictable wet weather patterns are reducing harvest yields disrupting both crop and livestock production. In Brazil, erratic rainfall and rising global demand has strained coffee production. Cocoa output is being hit by extreme drought and disease, in West Africa. Rising feed and fertiliser costs are weighing heavily on cattle farming. Together, these issues are pushing consumer prices higher.

Supply constraints can largely be factored to climate change. Heavy droughts and unpredictable wet weather patterns are reducing harvest yields disrupting both crop and livestock production. In Brazil, erratic rainfall and rising global demand has strained coffee production. Cocoa output is being hit by extreme drought and disease, in West Africa. Rising feed and fertiliser costs are weighing heavily on cattle farming. Together, these issues are pushing consumer prices higher.

According to Amber Sawyer, an analyst at the Energy and Climate Intelligence Unit (ECIU). “Chocolate is just one of the many foods being made more expensive by climate change-driven extreme weather. These extremes will keep getting worse.”

Beyond climate challenges, geopolitical factors continue to reshape global supply chains. The war in Ukraine has led to higher energy and transport costs, which are rippling through to businesses across the food sector. Restaurants and hospitality venues are facing higher utility bills and payroll costs, ultimately having to pass these increases onto their customers. Over the last five years, food prices have risen by almost 40%. This reflects the combined impact of the COVID-19 pandemic, geopolitical tensions and climate disruptions. So there is no wonder the weekly food shop that used to cost £55 now is hitting triple digits!

The Bank of England forecasts that food price inflation will peak at around 5.5% by the end of 2025, before easing back to between 2% and 3% in 2026. However, these figures are not set in stone. With the autumn budget approaching, and the Bank still scheduled to hold three more interest rate meetings this year, the path will be heavily influenced by policy and data, due next month.

We will still be facing long term risks that suggests food inflation may remain high. Farmers, producers, distributors and consumers will continue to feel the pressures as climate change and geopolitical instability create disruptions.